2022 is the year for FTM imo

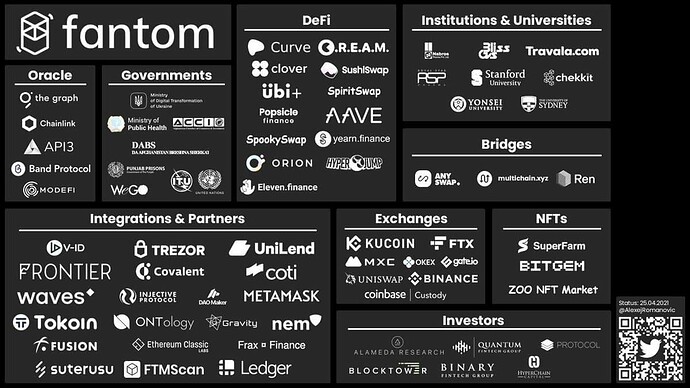

Fantom (FTM)

Market cap: $4,675,459,686

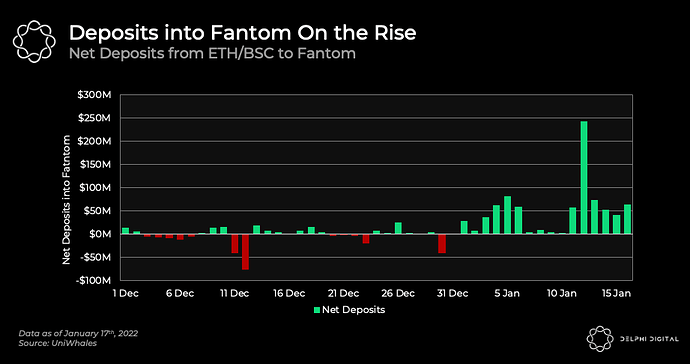

Total Value locked(TVL) is $7.98b

The Marketcap/total locked in value is: 0.58565

Something is obviously happening within the system and the market cap isn’t showing that, if more and more money going into a project and the market cap of the chain isn’t reflecting that it just shows it’s a sleeping giant, waiting for it’s moment.

For example Multichain $MULTI has $4.5B in FTM

Multichain Router allows users to swap between any two chains freely. It reduces fees and makes it easier to move between chains.

Multichain was born as Anyswap on the 20th July 2020 to service the clear needs of different and diverse blockchains to communicate with each other. Each blockchain has its own unique services that it provides, its own community and its own development ecosystem. For our industry to reach the next level for consumers, we need a fast, secure, inexpensive and reliable way to exchange value, data and exercise control between the chains.

The solutions developed by Multichain allow almost all blockchains to inter-operate. There is no restriction to Ethereum like chains (e.g. Binance Smart Chain), or different Layer 2 chains requiring finality to Ethereum (e.g. Polygon), or a network of Parachains (e.g. Moonbeam in the PolkaDot system), or Bitcoin types of chain (e.g. Litecoin), or COSMOS chains (e.g. Terra). These are either now all integrated, or on course for integration. With support for all ECDSA and EdDSA encrypted chains, Multichain is almost universally applicable as an interoperable layer.

Multichain is now the leader in the cross-chain field, with a rapidly expanding family of chains (currently 26) and daily volumes well in excess of $100 million

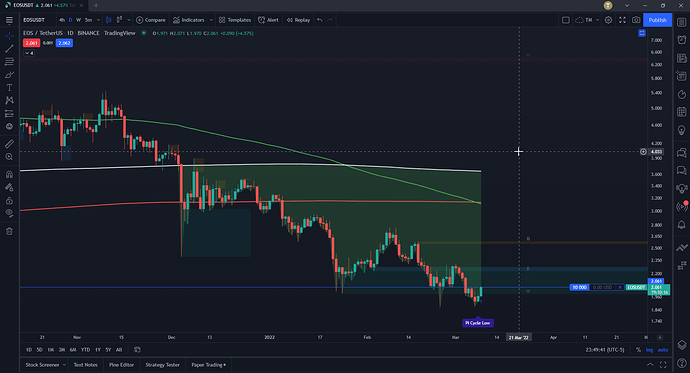

-breakdown on METIS, MAIA and HERMES and it’s mirroring relationship with SOLID of FTM.

-breakdown on METIS, MAIA and HERMES and it’s mirroring relationship with SOLID of FTM.

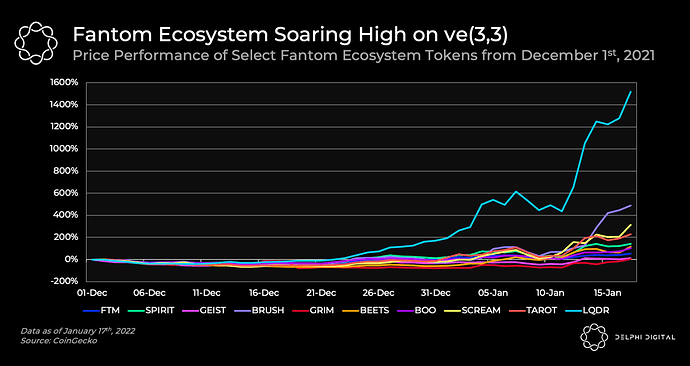

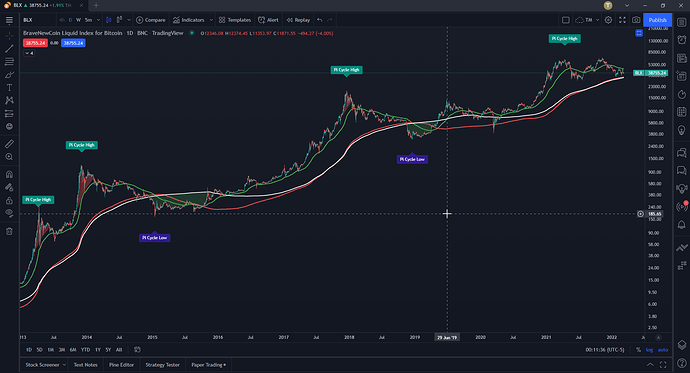

who wouldnt want that to happen again…

who wouldnt want that to happen again…

). Appreciate your inputs, dear friend

). Appreciate your inputs, dear friend